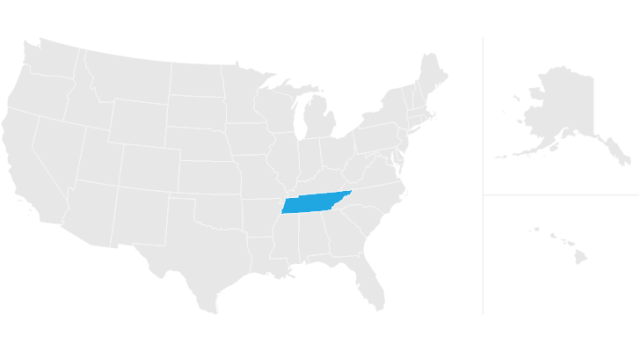

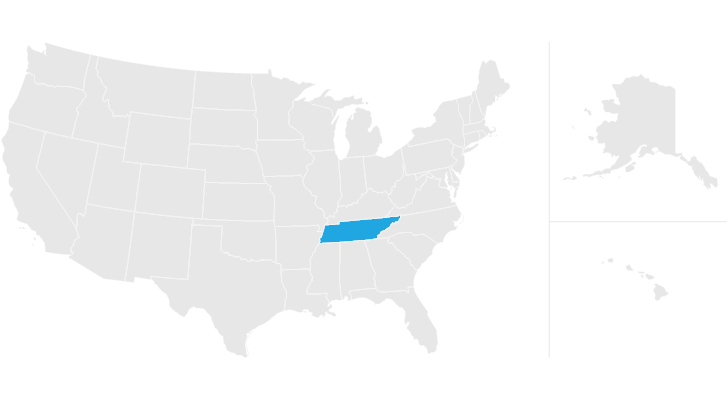

does tennessee have estate or inheritance tax

Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. However if the value of the.

Landscape Of Alabama Topography Map Topographic Map Terrain Map

For example the neighboring state of Kentucky does have an inheritance tax.

. No estate tax or inheritance. The inheritance tax is paid out of the estate by the executor administrator or trustee. In fact it doesnt matter the size of your estate there will be no state level tax assessed.

Tennessee does not have an estate tax. It is one of 38 states with no estate tax. For the purposes of this post we are going to address the last question about Tennessees inheritance tax.

Tennessee is an inheritance tax and estate tax-free state. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. There are NO Tennessee Inheritance Tax.

The exemption is 117. If the total Estate asset property cash etc is over 5430000 it is. It has no inheritance tax nor does it have.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. All inheritance are exempt in the State of Tennessee. The taxes that other states.

The inheritance tax is no longer imposed after December 31 2015. Technically Tennessee residents dont have to pay the inheritance tax. In 2016 the inheritance tax will be completely repealed.

Inheritance Tax in Tennessee There are NO Tennessee Inheritance Tax. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. Estate Tax In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time.

However it applies only to the estate physically located and transferred within the state between. Until that time estate. This is great news for residence.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

What is the state of Tennessee inheritance tax rate. According to the Tennessee Department of Revenue. Tennessee is not impose an estate tax.

2016 Inheritance tax completely eliminated.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Here S Which States Collect Zero Estate Or Inheritance Taxes

Is Your Inheritance Considered Taxable Income H R Block

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

Sell As Is Now Visit Https Www Webuycolumbusproperties Com For More Details Or Call Text Me Home Buying Being A Landlord Title Insurance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Prove Funds Are Inheritance To The Irs

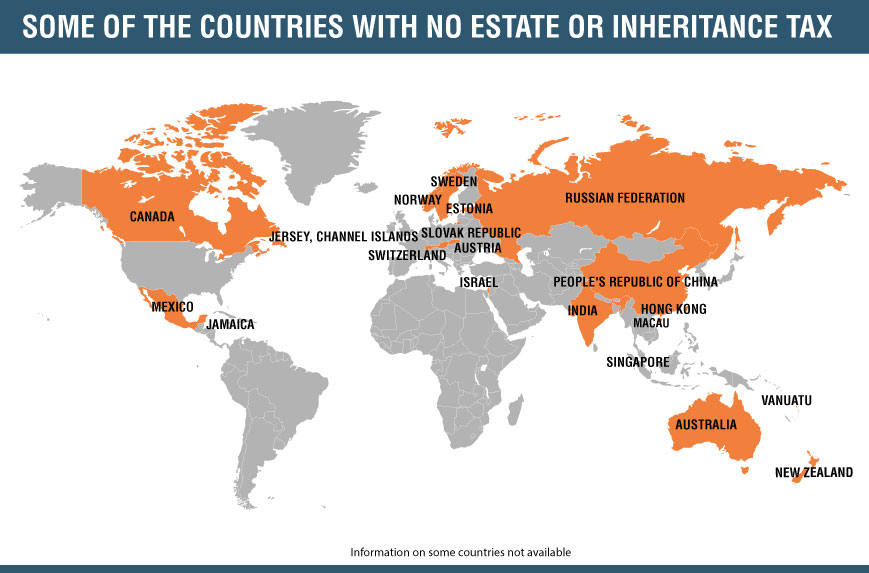

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Is There A Tennessee State Estate Tax Mendelson Law Firm

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Tennessee Estate Tax Everything You Need To Know Smartasset

Here Are The 10 Best Cities In Wyoming To Retire In Wyoming Cities Best Places To Live Wyoming